Save flat 35% on Assignment

If you’re seeking professional support for drafting detailed corporate finance assignments and analyses, visit New Assignment Help USA for expert writing assistance

FIN7A1/FIN7F2 Corporate Finance Assignment Sample

The different kinds or types of financing employed to raise funds for Hilton mainly include debt and equity which constitutes 17.3% and 82.7% respectively. The quantum of debt is considered to be 17.3%, while the quantum of equity is considered to be 82.7% and this is substantiated based on the weighted average cost of capital structure.

The debt source of finance is predominantly identified with facilitation of loans and borrowings by a company to propel future investment funding. The principal advantages associated with debt source of financing mainly include non-partition of company ownership by Hilton to acquire investments and funding. The qualitative advantages of using debt as a primary source of financing is deemed significant since it encourages organizations to maximize financial leverage and capital gearing which provides higher investment attractiveness (Ramzan et al. 2023). Therefore, debt is considered to be advantageous since it also allows a company to build a higher firm valuation which can be integrated with magnification of quantitative parameters that include sales, profit and total asset values.

In addition to locating the attached advantages of debt as a primary source of finance, the disadvantages are a significant area of concern for Hilton group to ensure capital structure formation. The main disadvantages associated with debt financing include the increasing financial obligations on part of Hilton group for paying back principal as well as interest amount on loans taken. As per critical illustrations and explanations of Cheng et al. (2022), the higher acquisition of loans and borrowings can also impact operational and financial stability that might lead to obliterated business credentials.

From the perspective of a qualitative trade off, it can be identified that the proportion of debt for Hilton group is significantly lower in comparison to the proportion of equity. The low proportion of debt might induce lower financial attractiveness and lower prospect of fetching a higher quantum of debt investors which might jeopardize future investment planning. As per critical views and explanations of Obiero and Topuz (2022), the lower proportion of debt also reduces organizational value for a company which can lead to higher company ownership being parted to secure funds for future investments. However, in the country, the identification of a lower debt proportion also reduces the possibility of investment-oriented risks since leverage or capital gearing is relatively on the lower side. The lower risk might become vulnerable to fluctuations in economic parameters that involve inflation and changes in interest rates.

The consideration of adopting an optimal capital structure is significant for Hilton group since it establishes the preliminary financial structure to empower business growth and progression through investments. The consideration to adopt an optimal capital structure is highly dependent upon how Hilton group manages its debt and equity mix while simultaneously determining strategies to reduce cost of capital applicable. The placing of an optimal capital structure is also dependent upon how organizational wealth is maximized while simultaneously reducing the possibility of increased financial obligations that might affect business perpetuity (Antill and Grenadier, 2019). The identified capital structure of Hilton group is deemed to be more inclined towards an equity form of capital structure composition where financial value development is established based on considering catalysts as ordinary and preference shares. The following is a brief discussion about optimal debt ratio for Hilton group substantiated through numerical calculations as well as a detailed analysis.

|

Calculation of Debt Ratio for Hilton Group |

|||

|

Particulars |

2022 |

2021 |

Growth % |

|

Debt |

13238 |

13241 |

-0.02% |

|

Total Assets |

15512 |

15441 |

0.46% |

|

Debt Ratio |

85.34% |

85.75% |

-0.48% |

Table 1: Calculation of Debt Ratio for Hilton Group

As per the above table of debt ratio calculation for Hiton group, the numerical values acquired in 2022 and 2021 are considered as 85.34% and 85.75% respectively. The debt ratio is formulated by considering the proportion of debt and total assets which signifies a marginally decreasing value for 2022 in comparison to 2021. The debt ratio identified for Hilton group is considerably higher and hence a marginal shift in transformation towards an equity driven capital structure formation is being implemented to reduce financial risks. Based on the capital structure approach, an ideal debt ratio is identified to range between 30% to 50% allowing a company adequate opportunity to raise debt capital from loans (investopedia.com, 2023). The higher percentile value of debt ratio might implicate credit rating for Hilton group which might also affect its future business progression and stability prospects.

Therefore, based on the cost of capital approach, the ideal debt ratio for Hilton group should have ideally been 40% which would have allowed the company to minimize financial gearing risks and make future investments more attractive. As critically explained and illustrated by Leland (2019), additional implications associated with a higher debt ratio also include potential effects in liquidity that can upset operational management and continuity. The following is a detailed discussion about the debt of Hilton group relative to the hotel and hospitality sector and market.

The above computation of depth ratio signifies that the company inter group contains a higher proportion of debt in relation to the proportion of equity carried. In order to rectify the debt equity mix, Hilton group has marginally transformed its capital structure decision making process where equity proportion is being highly encouraged to reduce company’s obligations for paying principal and interest amount on loans. The sectoral and market ratio to established composition of debt ratio signifies the range between 50% to 150% applicable for the hotel and hospitality industry globally (invest.lebijou.com, 2023). Therefore, it can be determined that the debt ratio of Hilton group falls between the industry and market range and provides better opportunities to facilitate acquisition of loans and borrowings. However, identification of alternative sources of funding should be contemplated as per the capital structure approach and decision-making framework to induce a better financial leverage balance and reduce capital gearing risks.

The recommended capital structure that should be used by Hilton group to enhance its future investments and reduce financial risks are advised to be dominated by the equity form of capital structure. The equity form of capital structure is identified to be suitable since it abolishes the obligation on part of organizations to payback funds acquired for future investments and projects (Belo et al. 2019). Adequate availability of shares and stocks are needed to be facilitated by Hilton group to empower a higher inflow of investors and shareholders who can provide financial and capital assistance. However, the equity form of financing requires Hilton group to part away its company ownership in favor of investors and shareholders which might cause partial disruption in its decision-oriented framework. In addition to adopting an equity source of capital structure approach, alternatives can also be explored by Hilton group which are segregated across four important categories of long-term, short-term, currencies and special features. The following is a brief discussion about identified methods through which finance can be raised from the above identified categories or sources.

The long-term source of financing that can be adopted as part of the capital structure revision mainly includes consideration of bank credit. Bank credit can be distinguished across two important categories of secured and unsecured credit where collateral securities are being pledged by Hilton group to acquire funding. The bank credit form of financing allows a company to increase its credit rating however interest rate payment facility obligations are needed to be induced to ensure security of collateral assets (Wang et al. 2019).

The short-term sources of financing that can be initiated by Hilton group as part of its capital structure overhaul include venture capital. The venture capital form of short-term financing allows a company to identify various investors and investment is received in small quantities and converged in a particular investment pool. This form of financing also allows Hilton group to maximize technological advancements and also reduces chances of impacts on credit rating.

The currency form of financing allows Hilton group to obtain overseas currencies by listing a part of its shares in an overseas stock market. The Overseas currencies that can be raised by Hilton group should prioritise Euro as the main overseas currency catalyst in order to acquire funding from foreign investors. This method of alternative financing can boost contingency credit rating for Hilton group since a considerable part of foreign reserves can be kept as backup if business volatility is experienced. However, as critically explained by Gopinath and Stein (2021), the currency form of financing is highly volatile and fluctuates on a regular scale which might impact financial sustainability and position, causing disrupted capital structure formation.

The special feature form applicable for Hilton group is mainly connected with adopting a leasing source of finance to facilitate funding of future investments. The leasing source of financing allows Hilton group to raise capital by mortgaging a part of its capital assets or equipment in favor of the lesser (Pinto et al. 2020). Alternatively, the process of lease financing can be termed as hypothecation whose potential benefits and drawbacks could include a higher capital value acquisition and high time consideration respectively.

The dividend stock and buyback policy of a company is an important indicator to gauge overall financial facilities made in favour of investors based on operational profits or retained earnings generated annually. As per opinions and views of Nechaev et al. (2022), the dividend stock and buyback policy are largely dependent upon various theoretical implementations guiding how profitability is to be utilized by a company and in what proportions. The following is a detailed discussion about dividend stock and buy back policy applicable for Hilton group determining the overall prospects of cash returned to owners, dividends paid or stock bought back.

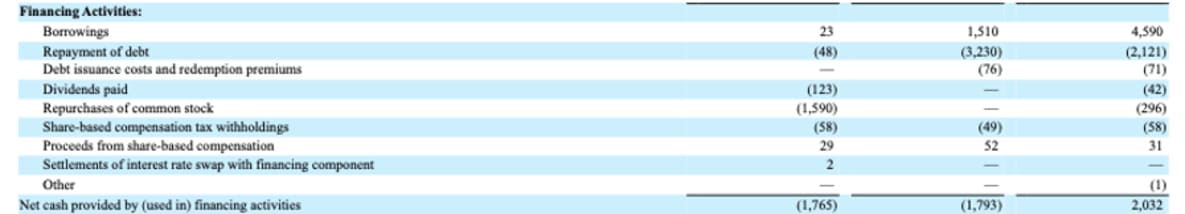

Cash return to owners is an important part of the Dividend policy initiated by Hilton group to ensure a proportional percentage being allocated in favor of investors considering profit generated from continued business operations. The return of cash to owners is being facilitated on the back of dividends paid in 2022 which includes a numerical expression of $ 123 million. Moreover, buyback of stock facilitated by Hilton group in 2022 can be determined on the basis of common stock repurchased that contains a numerical value of $ 1590 million. Therefore, it can be established that both divide and facilitation and buyback of shares has been initiated by Hilton group in order to boost its dividend policies for ensuring better business and financial drive-in future.

The total accumulated value of cash can be identified based on determining the total outflow experienced for financing activities under the cash flow statement. The total cash utilised for financing activities as of 2022 for Hilton group includes a numerical value of $ 1,765 million which has marginally reduced in comparison to 2021 containing a numerical value of $ 1,793 million. Overall, it can be identified that cash utilization in favor of owners and investors is sustainable for Hilton group to ensure better establishment of relationships with stakeholders and boost equity capital value subsequently.

Figure 1: Cash flow from financing activities of Hilton Group

The Dividend policy implemented by Hilton group is considered to be the residual dividend policy which is mostly paid based on available profits that are to be proportionally allocated in favour of owners and investors. The peer group comparison of dividend policy for Hilton group can be examined with Dividend policy initiated by IHG which predominantly follows a stable dividend policy. The facilitation of a stable dividend policy is mainly conceptualized based on paying a fixed percentage of dividends in favor of shareholders irrespective of company performance or market fluctuations. The stable Dividend policy for the competitor IHG can be numerically expressed in terms of total dividend paid in 2022 that contains a numeric value of $ 233 million.

Therefore, it can be established that the dividend paid by IHG is marginally greater than the dividend paid by Hilton group. The higher facilitation of dividend payment further encourages a company to harmonize investor relations and anticipate favorable prospects in future to attract more investments. However as per critical narratives of Wei (2020), the higher facilitation of dividend payments in favor of investors also reduces the scope and monetary quantum to promote future investments. In future this can degrade company valuation and hamper competitive positioning available in the market.

The identified dividend policy of Hilton group is residual dividend policy and it is recommended that a different policy should be chosen in future. The dividend policy that is recommended to be followed by Hilton group is identified as the stable dividend policy which would allow the company to fix a particular dividend payment irrespective of financial and capital market performances. As per explanations and views of Ali (2022), the implementation of a stable dividend policy also encourages an organization to keep proportional reserves of profits and retained earnings that can be used for future investments and capital projects.

Implementation of stable dividend policy by Hilton group also encourages the company to maintain a streamlined flow of business operations without factoring how investor integrity and harmony is to be maintained. Hence the implementation of the stable dividend policy should allow a company to facilitate credible operations strategies to maximise revenue and profitability output. Moreover, the advantages of implementing a stable dividend policy also include the scope of guaranteeing share value stability. The guarantee for share market stability should allow the company to perform superiorly in the capital markets and ensure accomplishment of a higher market share in the hotel and hospitality industry of the USA.

Figure 2: Dividend Policies

(Source: wallstreetmojo.com, 2022)

The steps needed to be ensured for returning cash to stakeholders mainly recommend the consideration to implement the buyback form of returns. The facilitation of buyback form of cash returns to stockholders should allow Hilton group to maintain a healthy earnings per share ratio which would magnify overall firm valuation in future. Alquhaif et al. (2020), expressed and idealized that advantages of facilitating the buyback form of cash returns should also allow a company to pay recurring premium on buyback in favour of investors in order to boost financial integrity. The additional advantages of implementing the buyback method of returning cash to stakeholders include tax benefit and higher flexibility in favor of Hilton group that can be channelized towards financial organizational growth. Various methods can also be implemented to enact share buyback where auction tender offer as well as open market purchase method can be suitably adopted.

Figure 3: Share Buyback form of dividend policy

(Source: efinancemanagement.com, 2021)